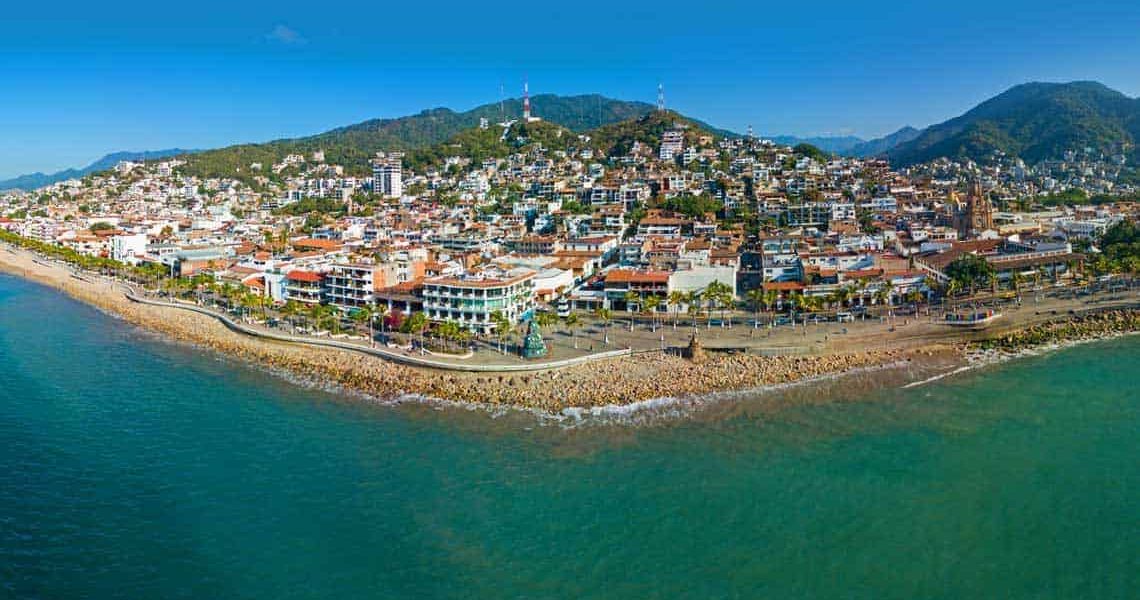

A question buyers and sellers of real estate in Vallarta often ask is why, when the official currency of Mexico is the peso, is real estate sold, or at least “tourism” real estate, sold in US dollars?

Vallarta is not alone. Other major tourism real estate destinations that are popular with Americans and Canadians also sell real estate in dollars. So how did this trend become established?

One of the reasons is that it makes it easy for Americans and Canadians to deal with. They don’t have to make the exchange rate adjustment, the price is what it is, in USD. When you have an peso exchange rate that is continually changing, (which it usually is), this means the price you’d be paying in USD is also changing. So if the exchange rate is 10-to-1 and the asking price was 1 million pesos, that converts to US$100,000. But if the exchange rates goes up to 11-to-1, well now the property is selling for roughly US$99,000. So to keep it simple, someone decided to just keep it in USD for the gringos.

But there’s another good, perhaps even better, reason.

Mexico has alway been plagued by inflation. At times there have been large jumps in the exchange rate, (like in 1994, again in 2008, and most recently in 2016), which can happen at anytime. Now for builders who have to pay for materials that originate from the U.S., or for products made in Mexico but with U.S. materials, if there is an exchange rate jump they could find that there profit margin has just been reduced, perhaps even losing money, because of an increase in building costs. So to cover or “hedge" themselves, they sell in dollars. Which in that case, if there is a rate drop, it can actually be to their benefit, as they’ll be receiving more pesos and the majority of their expenses are in pesos. Building a home or condo project can take over a year and a lot can happen in that time. So selling in USD made sense. And the tradition has continued.

It has a potential downside, however.

Properties are registered at the land title office in pesos. So, using the previous example, if you bought a condo for US$100,000 and it was registered when the exchange rate was 10-to-1, it would show on title at 1 million pesos. If a few years later you sold the property for the same price (US$100,000), but the exchange rate was now 11-to-1, this would show you were selling the property for 1.1 million pesos, meaning on paper your property appreciated by 100,000 pesos. And that’s taxable at 35%. Meaning, even though you sold the unit for the same price you sold it for, you’d still be liable to pay taxes, and in this case, 35,000 pesos. Now imagine if the exchange rate was now 15-to-1!

Now, it isn’t quite so simple, they are some expenses, in certain situations, that you can apply against the tax bill. If you are in this situation, however, it would be best to talk to a real estate lawyer to know exactly where you stand.