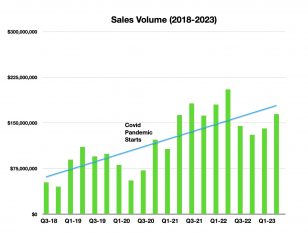

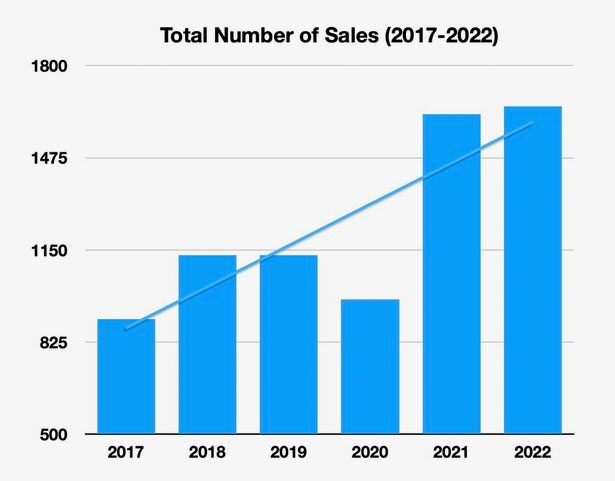

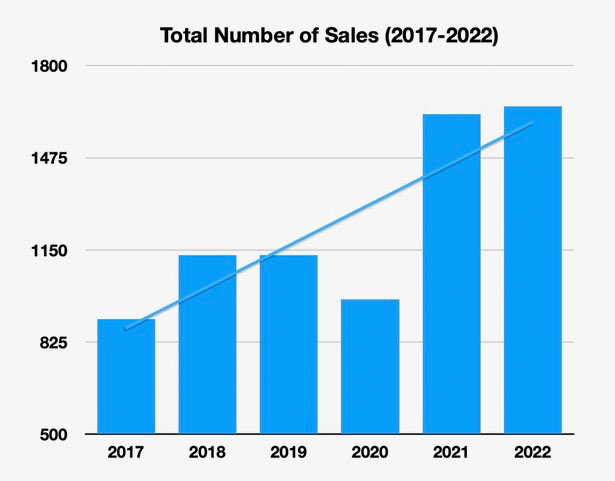

2022 turned out to be another exceptional year for the local real estate industry performing slighting ahead of 2021 in terms of both dollar volume and number of sales. And there’s no better way to review how they year went than with charts, which always speak louder than words, and certainly can be more fun to explore.

After losing ground in 2020 to covid, sales rebounded robustly in 2021 and managed to keep it up into 2022.

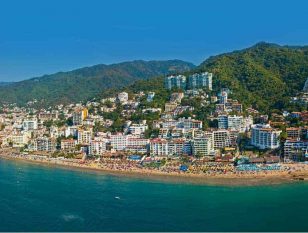

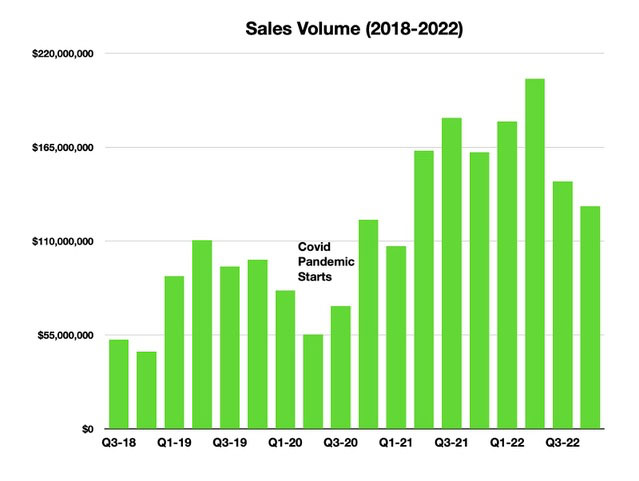

On closer inspection, however, by reviewing sales volume by quarter we see the market has dropped considerably since mid’ year, as shown in the chart below.

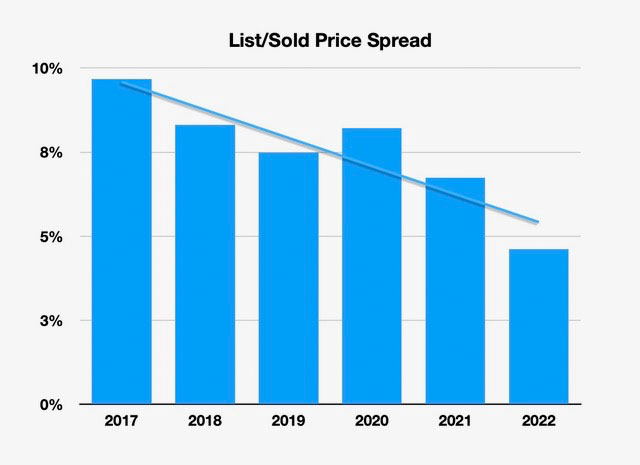

And it doesn’t seem to be for lack of demand, but rather it’s a supply problem - there just aren’t as many people interested in selling as there are people wanting to buy, and new product development is having a hard time keeping up. Whenever inventory becomes scarce, it usually leads to a considerable difference between the listing or asking price, and the eventual agreed-upon sales price. Back in 2017, the spread was nearly ten percent. In 2022 it was less than five percent.

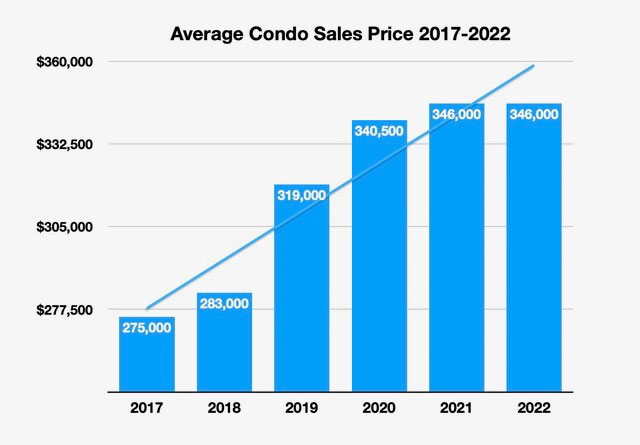

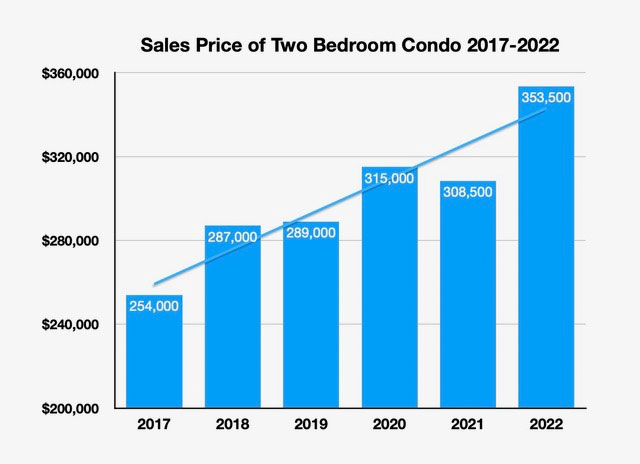

And although the average condominium sales price remained the same as in 2021, when we look at just two-bedroom units, we see they are continuing to get increasingly more expensive. Which, again, we’d expect when demand is greater than supply.

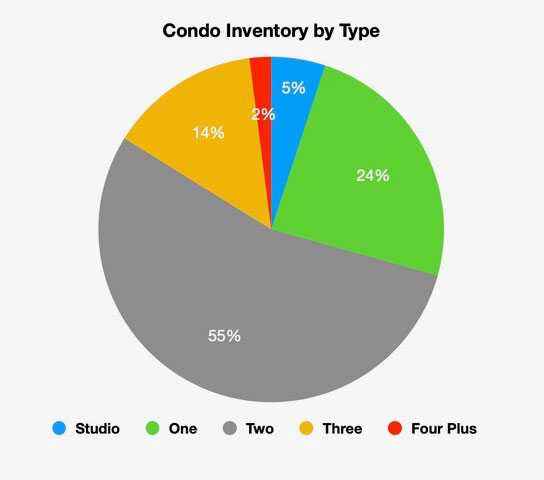

The two-bedroom condominium is by far the most popular type of condo preferred by buyers, holding 55% market share and has done so long as we’ve been providing statistics on the region. And the split has remained this way quite consistently over the years for all bedroom-unit types.

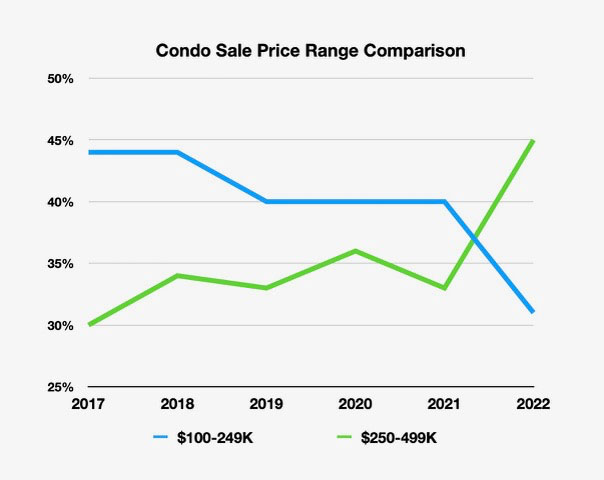

When considering the inventories of condominiums by price range, as shown below, the perceived trend is that real estate prices are getting more expensive. In 2022 there will only five condo reported sold for under $100,000 (in blue below).

The most drastic changes we seen in price ranges lies between $100-$249,000 and $250-$500,000. The former used to make up nearly 45% of the market whereas the latter made up only 30%. In 2022 they reversed one another with condos between $250-$500,000 now making up 45% of the overall condo market.

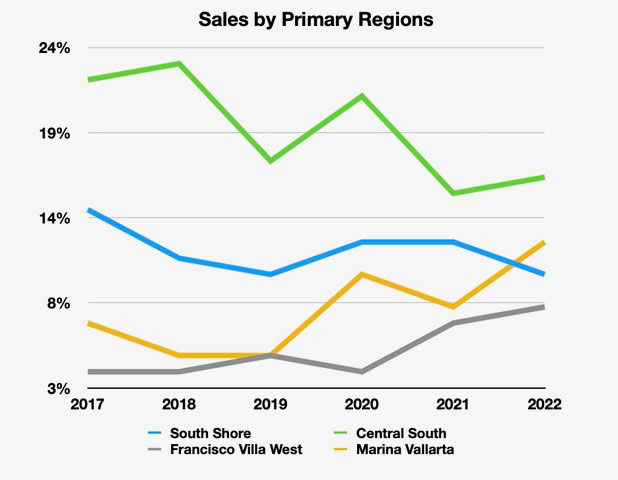

There’s been some interesting shifts in market regions as well. The downtown region, south of the Rio Cuale known ans Central South, has been dominating sales for years, but it has been dropping, from taking 23% of all condo sales in 2018 to just 16% in 2022. Where’s the growth to make up for this? Coming from a resurgent Marina Vallarta and Francisco Villa, the region between the Hotel Zone and Avenida Francisco Villa, also commonly known as Versalles, Gaviotas, Fluvial or Diaz Ordáz.

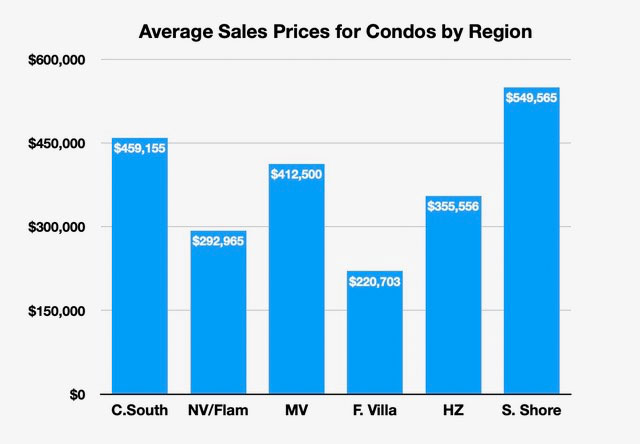

This increased demand for Francisco Villa is probably because of the average price per condo in this area, which is substantially below that of over popular regions, as shown below.

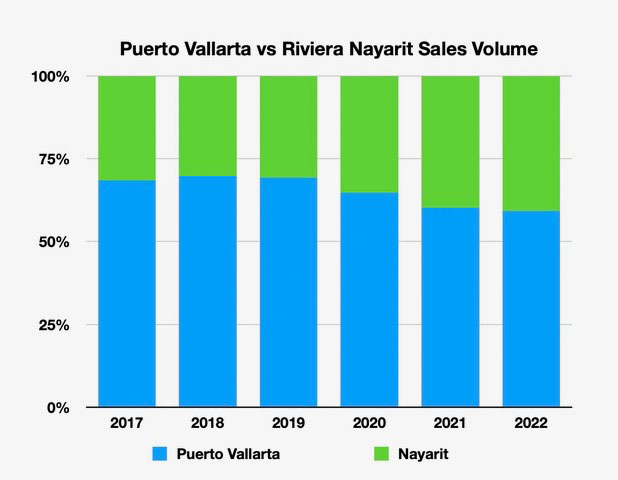

Another trend, although a slower one, is the transition from a dominant Puerto Vallarta market to a much stronger Riviera Nayarit market. This has been going on for years and probably won’t be changing anytime soon as that’s where the land is - there just isn’t as much, especially beachfront, in Puerto Vallarta. And the South Shore is limited by the coastal mountains and the fact that most of it isn’t accessible by road. Riviera Nayarit is also much closer by road to primary national markets such as Guadalajara and the Bajio region.

Overall a very interesting year, setting up for what will most likely continue to be quite interesting moving into 2023 where there are rumors of recessions to the north, higher interest rates and slowing American and Canadian real estate markets - how will these conditions, if they continue to play out, affect the local market?

The following graphs are generated from information provided by members of MLSVallarta and FLEXMLS, two MLS systems operating and servicing the Puerto Vallarta - Riviera Nayarit regions. Missing from these numbers is Punta de Mita which is an upscale, market-unto-itself. Real Estate here is sold by a few agencies that tend to specialize in just this area, and report few of their sales. It is estimated, however, to generate sales volume somewhere around $200 million, or about 25-30% the size of the overall Vallarta/Nayarit market.