"America is aging. As the Baby Boom begins to enter retirement years, new challenges are arising with significant implications for both borrowers and lenders. In particular, given the impact of aging on memory and other cognitive skills, there is a need to consider the implication for financial decisions made by older individuals. By the time individuals are arriving into traditional retirement ages, when many important financial decisions are made, cognitive skills are already in decline as part of normal cognitive aging.”

So begins a recent study by the Mortgage Bankers Association entitled Cognition and the Housing Behavior of Older Americans, which was drawn from interviews with approximately 25,000 Americans in 2012 and is a sample representative of 43 million individuals 65 and older.

We are living longer, and the retirement period of retirement today has been extended, once a period traditionally seen for slowing down, taking on fewer responsibilities, no longer challenged by work, only by, so it is suggested, by play. But not continuing to be challenged can lead to a loss of cognition skills. Memory and cognition seem to hold on relatively stable into our 70s, but then decline fairly rapidly thereafter. Likewise, the incidence of memory disease rises steadily with age. By age 90, the study reports, about 20 percent of us will suffer from memory disease, which will lead to difficulty in managing money. And as increased longevity pushes financial decisions to later ages, any way that cognition can be improved and/or its natural decline forestalled, are welcome.

"If, as the adage goes, 85 is the new 65, then 85-year olds will be faced with many financial decisions that 65-year olds once made, but now with lower cognitive acuity. Finally, with population aging, each year there are just more older individuals. So, greater cognitive burdens are be placed on greater portions of adult America."

The study reports that "cognitive skills are seen as critical determinants of financial outcomes and economic well-being over the life course. Cognitive psychologists often divide skills into those involving fluid intelligence and those involving crystallized intelligence. The former are thinking skills: executive function, abstract reasoning, and memory. These peak in the teenage years and then slowly depreciate with age. As individuals age through their early and mid-adult lives, the decline in fluid intelligence is offset by rising crystallized intelligence, which can be characterized as knowing skills, accumulated from formal and information education, training, and life experiences. These rise with age until individuals hit their 50’s and then decline. So, by the time individuals are arriving into traditional retirement ages, when many important financial decisions are made, cognitive skills are already in decline as part of normal cognitive aging."

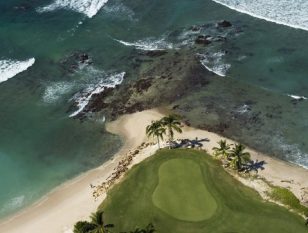

Many who own property in Vallarta also have a home in their place of principal residence as well. This means twice of everything to take care of, and that can be demanding, especially financially. We want to ensure we are making the best decisions regarding our homes, which for many are the largest assets they own.

What can one do? One method we should all implement that the study recommends is the “use it or lose it” approach, in which more stimulating environments help to preserve, and perhaps enhance, cognitive acuity. By keeping active, both mentally and physically, any number of ways. Perhaps continuing to work part-time, writing that book you’ve always wanted to do, or becoming an expert in some field. Which, in this age of the Internet, is not difficult to do.

But that isn’t enough, as the study notes. As we get near 80 we all should have someone we have confidence in, younger than us, that we can discuss our financial matters with. In the best circumstance, a son or daughter, or a past, close business associate. Many may have been working with a financial advisor over the years, problem is they are aging right along with us so change may need to be made. But we shouldn’t go into our later years concerned about our finances, making a bad decision, because of what we inevitably cannot avoid.